Term Loans

Grow and Invest Your Business

Rowett Financial Term Loans

Up to $500,000 annual interest rates as low as 8.99%

A term business loan is a form of fast financing extended to a borrower for an immediate business need, and typically repaid within about year or less. Because it is a temporary financing solution, a short term loan is an excellent option for borrowers who need working capital for a specific business purpose, like covering a cash flow gap or purchasing equipment. Short term financing can be particularly beneficial for seasonal businesses that want to maintain cash flow throughout the year, as well as companies that regularly experience delays on accounts receivables to cover expenses. And because short term business loans have predictable repayment terms and no long term obligations, there are no surprises down the road.

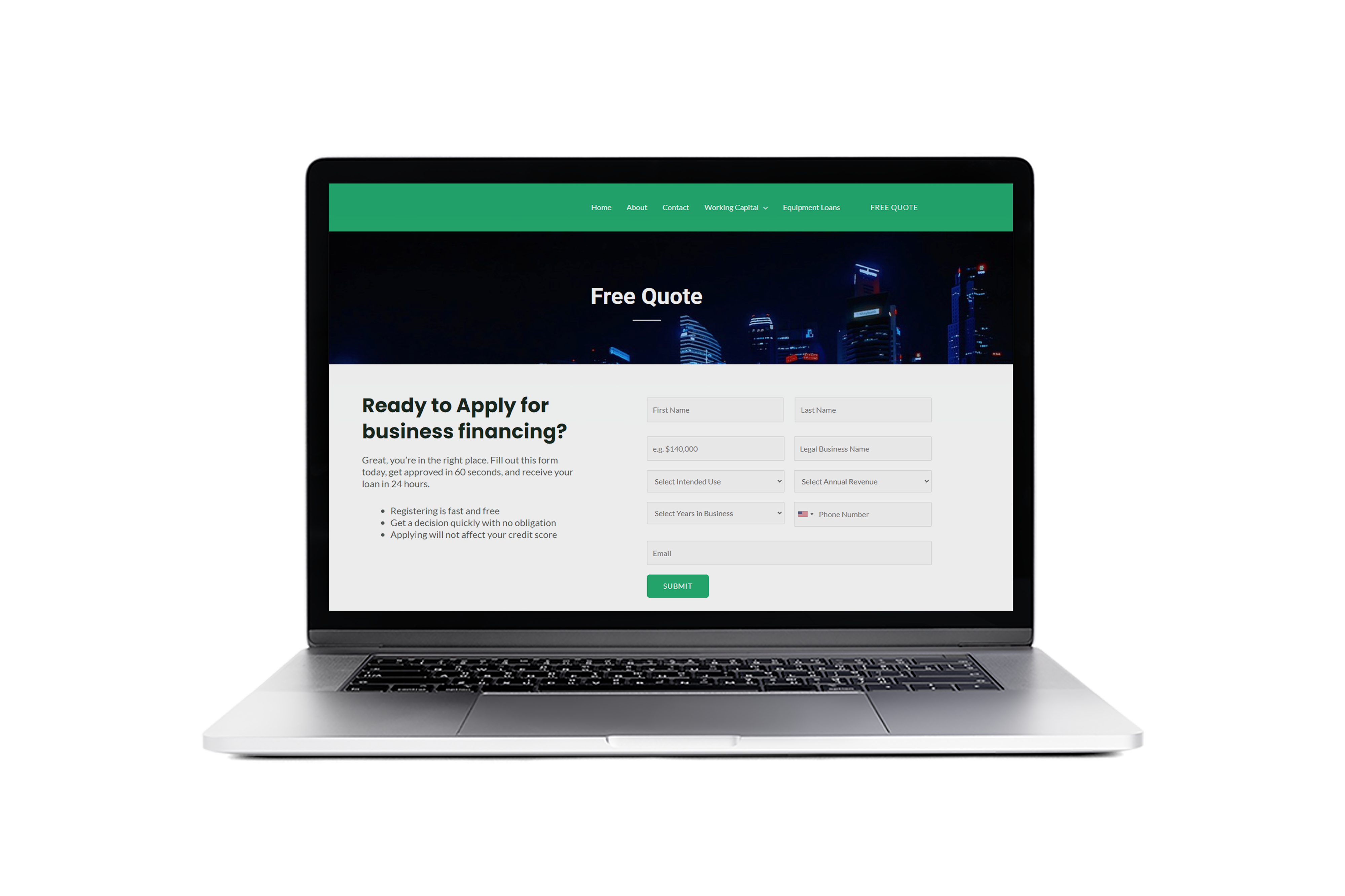

- Submit your online application within minutes.

- Receive a prompt follow-up from one of our representatives.

- Once your application is approved, funds are provided almost immediately.

6 – 60 Month Terms

Loans from $50,000 up to $500,000

Starting Rates at 8.99%*

Term Loan FAQs

Do I qualify?

- Personal FICO Score of 680+

- 3+ Years in Business

How do I pay back?

- Fixed monthly payments

- Automatically deducted from your business bank account

- We offer prepayment options, including potential interest reductions. They vary based on our assessment of your business and your credit

How is my rate determined?

- Your loan amount and rate will be based on our assessment of your business along with your business and personal credit profiles

*Rate and line amount will be based upon your business and findings.

Added Flexibility For Your Convenience

One of the best things about our loans is their flexibility. You are free to use your loan for almost any business expense you can imagine. The funds are yours, and we strongly believe our customers should be able to use them as they see fit. That being said, it is important to only take out a loan for important business expenses.

In addition, you should note that paying back your loan on time can possibly increase your credit score. Business owners with higher credit scores tend to have more borrowing power and lower interest rates.